The Customer Experience: 5 Steps to Develop Deep Customer Insights

By Dana Ginn

While most organizations are committed to improving their customer’s experience, many still do not produce a meaningful or positive impact for the customer. In fact, only 30 percent of businesses are making changes based on customer insights, and even fewer are realizing a measureable and significant difference in customer and business value metrics as a result.

What’s happening?

The most common mistake is that organizations do not fully understand the real needs and expectations of the customer, and they end up creating new solutions or experiences that are just not that important from the customer’s perspective.

To avoid this mistake, the Lean Methods Group’s answer is a five-step process to develop deep customer insights prior to initiating any changes.

Step 1: Map the Customer Journey

First, select one customer journey to focus on based on your business strategy and the customer data you already have. Then create a customer journey map, which shows each of the steps your customer goes through while using your products and services. Adding the positive or negative experiences your customer has along each step creates a customer experience map. The boundaries of the journey map can vary from broad (e.g., the lifetime of your customer’s engagement with your organization) to narrow (e.g., engagement with one product or a portion of one service).

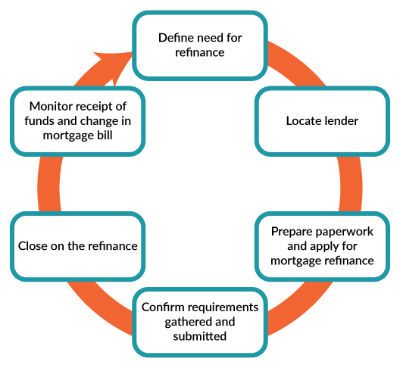

A simplified version of a customer journey map for refinancing is shown here.

If you are unable to define which journey to work on, review your strategy, explore market and technology trends, and generate insights gained from using advanced data analytics.

Step 2: Identify the Jobs To Be Done (JTBD) and Customer Outcome Expectations in the Targeted Customer Journey

The jobs customers are trying to accomplish while hiring your product or service are called the Job-To-Be-Done. They can be classified as functional, emotional or ancillary.

Functional jobs define the functional tasks we want to accomplish (e.g., brush teeth, floss teeth).

Emotional jobs include the way we want to feel when doing a certain job (e.g., feeling of freshness) or how we want to be perceived by others while performing a certain job (e.g., be perceived as having an appealing smile or fresh breath).

Ancillary jobs describe the related jobs we want to do while accomplishing the main job (e.g., whitening teeth).

Outcome Expectations (OE) are the desired and undesired outcomes the customer or the provider has for each step and JTBD. For example, for the JTBD of brushing teeth, customer OEs may include maximize visible stain removal, or minimize damage to gums, and provider OEs may include minimize cost to produce and minimize environmental damage.

When identifying JTBDs and OEs, we know that asking customers directly is not a reliable method to accomplish this step. If asked, customers tend to offer ideas on how to tweak an existing product or service, or jump to new solutions.

Instead, use ethnography—the science of observing, listening and analyzing the artifacts of customer behavior—to uncover JTBDs and OEs. Through ethnography, you and your teams can capture the real insights needed to target the right improvement of the customer experience.

For example, again using the bank refinance process, after using ethnography to observe customers and listen to recorded phone calls of prospective customers, the team identified JTBDs and a long list of OEs, a few of which are shown below:

JTBD:

- Functional: Secure funds for large family expenses

- Emotional: Feel like I am making a good decision for my family

Customer OEs:

- Minimize rate on refinance

- Minimize time to secure funds

- Minimize effort to secure funds

Step 3: Validate the JTBDs and OEs

You now have a list of JTBDs and OEs discovered through observation from a small sample of customers. But many questions remain, such as “Was our sample really representative of all customers? Did we miss any important jobs or OEs? When we recorded our findings, did we use the same language that customers used and that will resonate with other customers?” Focus groups and interviews will help you validate your earlier findings and ensure a comprehensive and accurate picture of the customer base.

In the case of the bank, they invited the customers from the ethnography study and a small number of additional customers to participate in interviews and focus groups. The outcome was a refined list of JTBDs and OEs, some of which are shown below:

JTBD:

- Functional: Access money for large family expenses

- Emotional: Take care of all of my family’s needs

- Ancillary: Find other ways of accessing money beyond the typical bank institution

Customer OEs:

- Minimize rate on refinance

- Minimize time to get money to use

- Minimize effort to get money to use

- Maximize home appraisal amount

Step 4: Prioritize the Outcome Expectations From the Customer’s Perspective

Even after you are fairly confident you have discovered an exhaustive list of customer insights, two problems remain. Customers do not view all OEs as equal, and organizations do not have the resources to work on everything at once. The next step then is to prioritize the OEs that, if met, will create real differentiation and help you get the biggest bang for your buck.

Prioritization is done first from the customer’s perspective. The customers can rate each JTBD and each OE. A survey is the best tool to make this happen. When constructing the survey, ask about both the importance and satisfaction. You can then turn the survey results into a prioritized list of JTBDs and of OEs.

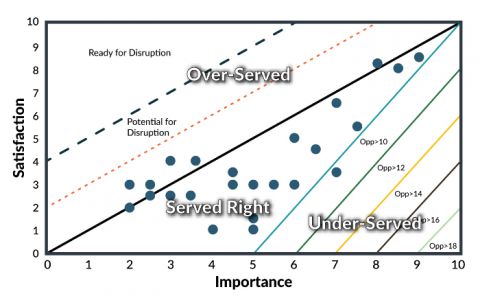

Here is a Prioritization Grid for the Mortgage Refinance Outcome Expectations:

Each point on this grid is one Outcome Expectation rated by customers on both importance and satisfaction. The horizontal axis “Importance” means the percentage of customers responding who rated the OE as “Very Important” or “Extremely Important” on a five-point scale. The vertical axis “Satisfaction” relates to the percentage of customers responding who rated the OE as “Very Satisfied” or “Extremely Satisfied,” respectively.

Plotting all surveyed OEs will allow your organization to identify which are under-served, served right or over-served and therefore pinpoint what to focus on first.

Step 5: Prioritize the Opportunities From the Business’ Perspective

Finally, at this step, you marry the customer’s perspective of prioritization to that of your organization. Some of the questions to consider include: Which opportunity will provide the most value to the business? Which opportunity is most aligned to the strategy of the organization? Which opportunity can be delivered on in the short-term and long-term?

At the bank, the team reviewed strategic fit and ability to execute and confirmed three of the most important OEs to focus on. In six short weeks, this team was able to build the foundation on which to create and deliver experiences that had direct and positive impact on what was most important to the customer.

Are you ready to deliver a solution that produces a meaningful and positive impact for the customer? Watch on-demand How to Turn Customer Insights Into Actions and Results.

Dana Ginn was a senior client partner with the Lean Methods Group.